Financial advisors are used to having close and trusting relationships with their clients, given the advisor’s involvement in the intimate details of the client’s financial life and the long-term nature of many advisor-client relationships. And it therefore occasionally happens that a client asks their advisor to serve as trustee for a trust they’ve created. But while being asked to serve as a client’s trustee may be a testament to the depth of the relationship, advisors should think twice in most cases before accepting such an appointment. Because while no regulations outright prohibit advisors from acting as trustees, the ethical, fiduciary, and legal conflicts that accompany serving as a client’s trustee can often make it more trouble than it’s worth.

At one level, advisors who act as both trustee and investment manager of a trust face an inherent conflict of interest, since they stand to benefit from the compensation they receive for managing the trust’s assets. Which isn’t necessarily prohibited under trust law, but does leave advisor-trustees open to having their decisions challenged by trust beneficiaries, where the advisor bears the burden of proving they acted reasonably and in good faith. Advisors must be prepared to demonstrate not only the prudence of their investment choices but also the fairness of their compensation arrangements with respect to the trust’s beneficiaries.

Compounding this, conflicts can also arise from the dual fiduciary obligations advisors owe when a client is also a trust beneficiary. Advisors are bound to act in their clients’ best interests, but trustees must remain neutral among beneficiaries, which may be impossible to reconcile when not all trust beneficiaries are clients of the advisor. For example, if an advisor-client requests a distribution that another beneficiary opposes, the advisor-trustee must navigate a fiduciary gray area where impartiality is required but loyalty to the client is also expected.

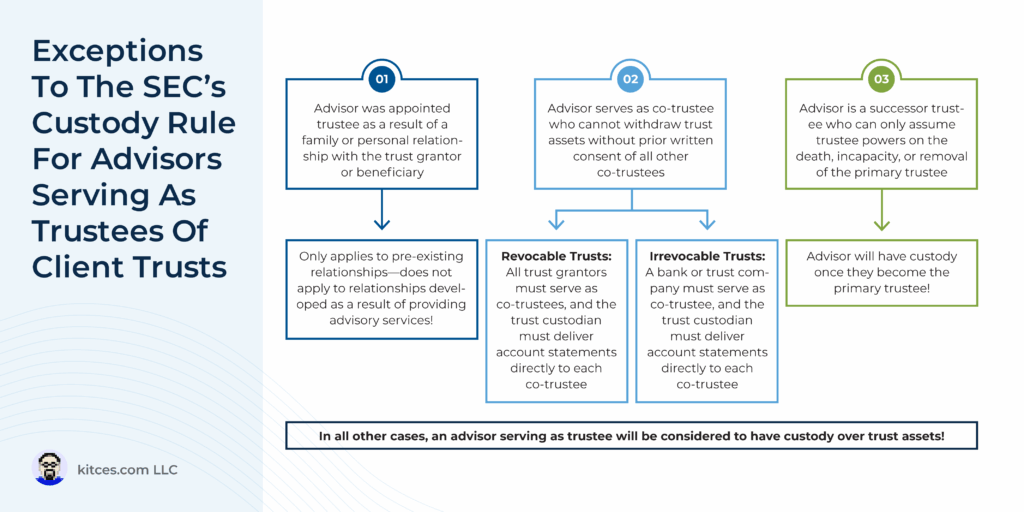

Regulatory considerations further complicate the matter. Advisors who serve as trustees are generally deemed to have custody of trust assets by the SEC and state regulators, requiring annual surprise audits – a time-consuming and expensive process typically borne by the firm. While there are exceptions for close family relationships or co-trustee arrangements, these are narrow and often impractical. For RIAs, being named as a successor trustee (stepping in only upon a client’s death or incapacity) can temporarily avoid custody, but full compliance becomes necessary the moment the advisor assumes control of the trust. Similarly, broker-dealer representatives face their own hurdles, as FINRA rules require pre-approval and ongoing supervision from the broker-dealer firm before acting as a client’s trustee, adding yet another layer of oversight.

Given these layers of complexity and risk, most advisors are better served by declining one-off trustee appointments unless they are prepared to offer trustee services as a structured, professional line of business. Advisors who pursue this route must establish clear client acceptance criteria, liability protection (including E&O coverage and legal entity structuring), and robust operational systems to fulfill their administrative and fiduciary responsibilities. These include managing distributions, tax reporting, beneficiary communication, and ongoing investment management. Done right, such a service can be a compelling value-add for high-net-worth clients who prefer a ‘one-stop shop’ for wealth and trust management, and can also serve as a differentiator in a competitive marketplace.

Ultimately, the question of whether to serve as a trustee comes down to intentionality and infrastructure. Advisors who say yes must be fully equipped – legally, operationally, and ethically – to fulfill both roles without compromise. For everyone else, the more prudent path is to build strong referral relationships with qualified corporate trustees or attorneys who can fulfill that role, ensuring clients’ needs are met while protecting the integrity of the advisor-client relationship. Either way, the goal remains the same: to honor the immense trust clients place in their advisor by ensuring their wishes are carried out with competence, impartiality, and care!

Read More…