Optimism about a deal in Washington, D.C., to reopen the federal government provided an early boost on Wall Street Wednesday, though questions about valuations continue to dog mega-cap tech names. The Dow Jones Industrial Average, relatively light on tech exposure, added to its impressive run during the shutdown and closed at another new all-time high.

The Dow is now up more than 6% over the trailing month. UnitedHealth Group (UNH, +3.6%) led the 30 Dow Jones stocks higher today after Chief Financial Officer Wayne DeVeydt reaffirmed management’s expectation that performance will improve in 2026 before new strategic initiatives begin to pay off in 2027.

Software maker Cisco Systems (CSCO, +3.1%) was up ahead of its post-closing-bell appearance on the earnings calendar. Nvidia (NVDA, +0.3%), meanwhile, surged late to post a gain a day after SoftBank sold its entire $5.8 billion stake in the bellwether of the artificial intelligence (AI) revolution so CEO Masayoshi Son can concentrate on a $30 billion OpenAI bet.

From just $107.88 $24.99 for Kiplinger Personal Finance

Be a smarter, better informed investor.

CLICK FOR FREE ISSUE

Sign up for Kiplinger’s Free Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

Among other Magnificent 7 stocks in the world’s second-oldest equity index, Microsoft (MSFT, +0.5%) also posted a gain. Apple (AAPL, -0.7%) was down modestly, and Amazon.com (AMZN, -2.0%) finished at the bottom of the index.

At the closing bell, the blue chip Dow Jones Industrial Average was up 0.7% at 48,254, a new all-time closing high and the first time Papa Dow has finished a trading session above 48,000. The broad-based S&P 500 had inched up 0.06% to 6,850, but the tech-heavy Nasdaq Composite was down 0.3% at 23,406.

AMD has EPS power

Advanced Micro Devices (AMD, +9.0%) did its part on behalf of semiconductor stocks after Truist analyst William Stein reiterated his Buy rating and his $279 12-month target price for the “emerging DC/AI ‘trusted partner’.”

According to Stein, AMD stock remains cheap, noting the company is growing earnings per share at a compound annual rate of approximately 45% through 2030 but trades at about 10 times 2030 “EPS power.”

AMD management said at its investor day presentation on Tuesday that it also expects 35% total sales growth and expanding margins, citing an 80% growth rate for server accelerator sales.

OKLO is still going nuclear

Oklo (OKLO, +6.7%) continues to demonstrate why it’s one of the best ways to invest in the nuclear revolution. And Wedbush analyst Dan Ives reiterated his Outperform rating and his $150 12-month target price on the stock.

“Oklo continues to see regulatory acceleration for its projects,” Ives writes, “with the DOE authorizing an approval to construct and operate a nuclear facility creating a modern pathway to get new nuclear plants built quickly.”

As Ives explains, “Oklo is setting the stage for nuclear energy to become widely adopted over the next decade as the AI Revolution data center buildout is driving significant demand for new energy to power these initiatives.”

Indeed, AI-driven computing power is expected to grow 10 times by 2030.

Shutdown math

The House of Representatives is poised to approve legislation to end the longest-ever government shutdown in a vote expected to happen around 7:15 pm Eastern Standard Time today. The compromise bill, which provides funding to keep the government operating through January 30, would then move on to President Donald Trump’s desk for signature.

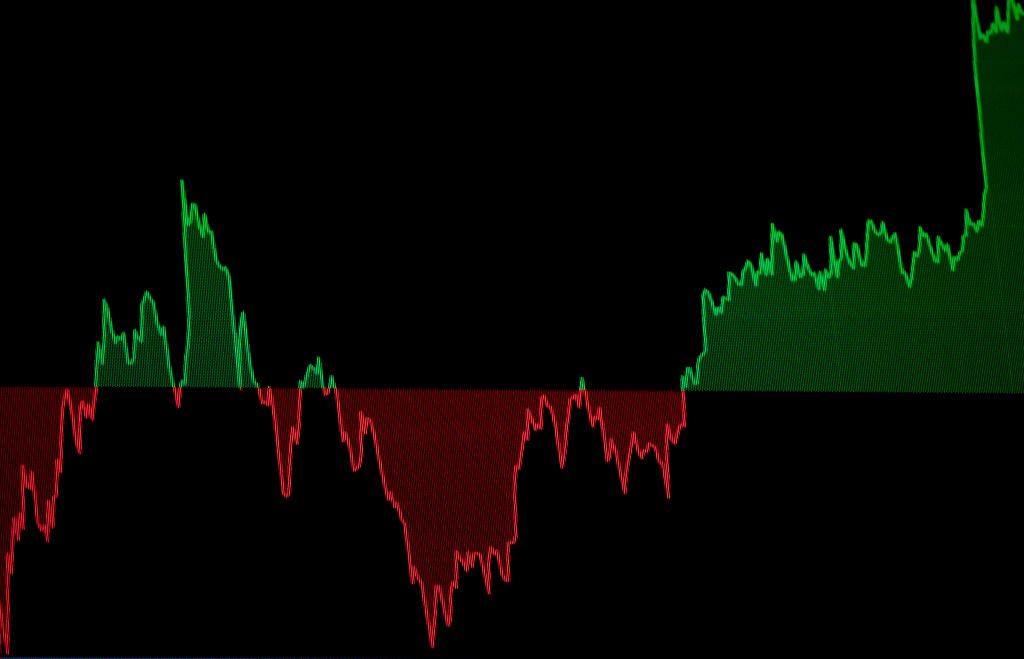

Despite the added uncertainty, notes LPL Financial Chief Technical Strategist Adam Turnquist, stocks have risen. “Since the shutdown began on October 1,” Turnquist writes, “the S&P 500 has gained 2%, with a peak-to-trough decline of only 3%.” Both of those performance figures are better than average for government shutdown periods.

Turnquist says there could be more upside from here: “Historically, removing the uncertainty from a government shutdown tends to support equities.” After 20 shutdowns since 1976, the S&P 500 has generated average one- and three-month returns of 1.2% and 2.9% vs 0.8% and 2.4% during all periods over the same time frame.

Landsberg Bennett Private Wealth Management Chief Investment Officer Michael Landsberg explains the stock market’s moves from a fundamental perspective: “There is a simple reason that stocks are up so much, and that’s because S&P earnings have handily beaten street estimates time after time this year, forcing much of Wall Street to play catch up.”

Landsberg is cautious, though: “The market had been flying blind with no data, and now as the fog lifts, we will see if market positioning has been correct and it is still clear sailing or if there is a big repricing necessary.”

With an abundance of incoming data filling up the economic calendar in the near future, investors, traders and speculators will re-focus on inflation, jobs and the next Fed meeting.