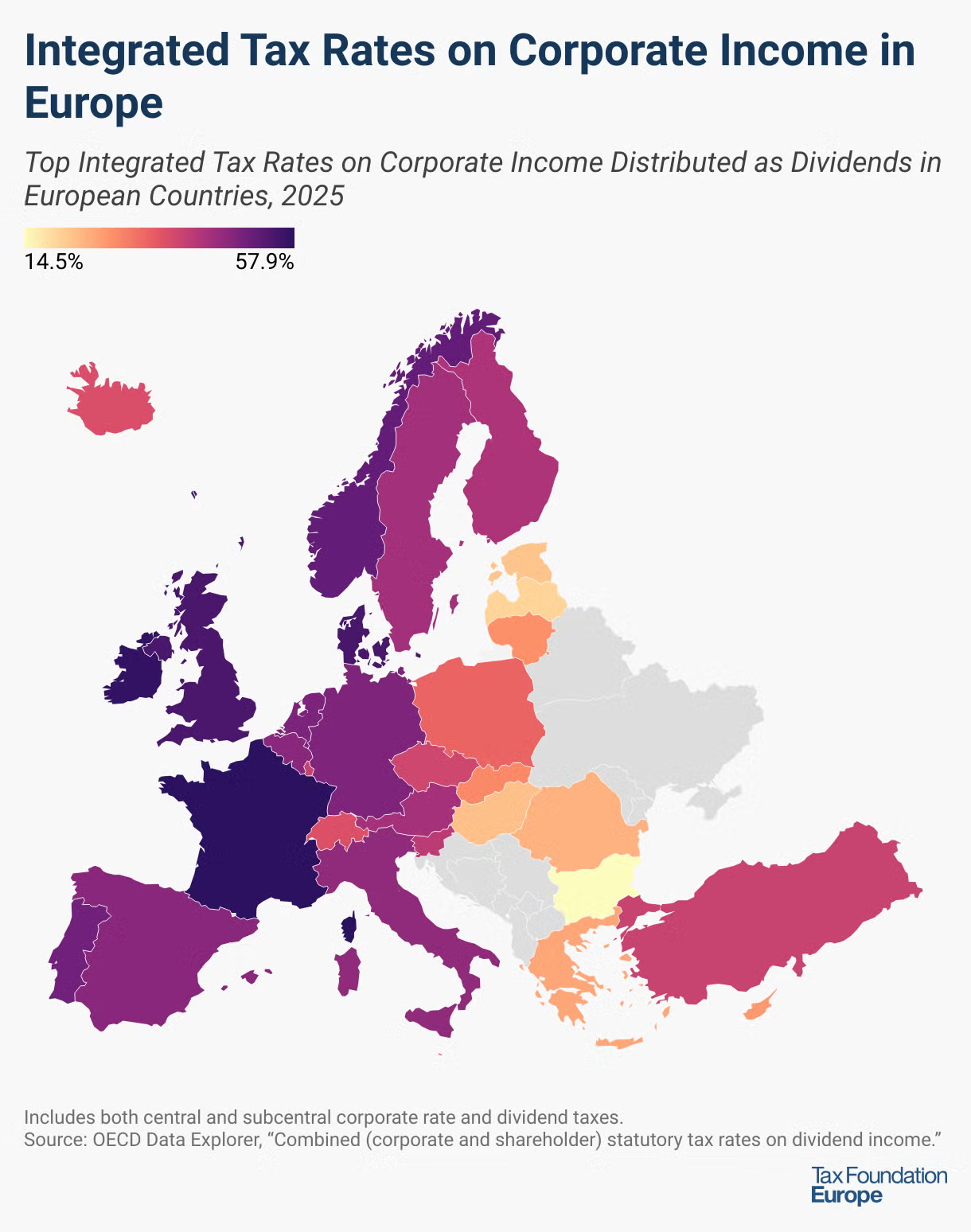

For dividends, France’s top integrated tax rate was the highest among European countries (57.85 percent), followed by Ireland (57.13 percent), Denmark (54.74 percent) and the United Kingdom (54.5 percent). Latvia (20 percent), Estonia (22 percent), and Hungary (22.65 percent) levy the lowest rates. Estonia and Latvia’s tax on distributed profits means that the corporate income tax is the only layer of taxation on corporate income distributed as dividends.

For capital gains, France (57.85 percent), Denmark (54.76 percent), the Netherlands (52.51 percent) and Norway (51.52 percent) have the highest integrated rates among European countries, while Cyprus (12.5 percent), Romania (16.84 percent), Bulgaria (19 percent), Switzerland (19.61 percent), and Greece and Slovenia (22 percent) levy the lowest rates. Several European countries—namely Belgium, Cyprus, Greece, Luxembourg, Malta, the Slovak Republic, Slovenia, Switzerland, and Turkey—do not levy capital gains taxes for long-held shares without substantial ownership, making the corporate tax the only layer of tax on corporate income realized as long-term capital gains.

On average, European countries levy an integrated tax rate of 39.23 percent on dividends and 36.03 percent on capital gains. In comparison, the United States levies an average integrated top tax rate of 47 percent on dividends and capital gains.

Double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of corporate income can lead to economic distortions, such as reduced savings and investment, a bias toward certain business forms, and debt financing over equity financing. Several European countries have integrated corporate and individual tax codes to eliminate or reduce the negative effects of double taxation on corporate income.

2025 Notable Changes

- Over the past year, some countries have raised their statutory corporate rates, including Estonia (from 20 to 22 percent), France (from 25.8 to 36.13 percent), Lithuania (from 15 to 16 percent), and the Slovak Republic (from 21 to 24 percent). Others have lowered their corporate tax rates, including Iceland (from 21 to 20 percent), Luxembourg (from 24.94 to 23.87 percent), and Portugal (from 31.5 to 30.5 percent).

- Five countries have raised their top personal tax rates on long-term capital gains, such as the Czech Republic (from 0 to 23 percent), Estonia (from 20 to 22 percent), Latvia (from 20 to 28.5 percent) Spain (from 28 to 30 percent), and the United Kingdom (from 20 to 24 percent). In contrast, Portugal has reduced its top personal tax rate on long-term capital gains from 28 to 19.6 percent.

- Spain increased its top personal dividend tax rate from 28 to 30 percent, while the Slovak Republic reduced its top personal dividend tax rate from 10 to 7 percent.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe