Federal payments to Medicare Advantage plans are adjusted for the health status of the plans’ enrollees through a process known as risk adjustment. Generally, payments are higher for people with more health conditions and lower for people with fewer health conditions. The purpose of risk adjusting payments is to ensure Medicare Advantage plans receive sufficient payments to cover the expected costs of enrollees with more health conditions who have higher expected health care spending. However, it also provides an incentive to Medicare Advantage insurers to document the health conditions of their enrollees more comprehensively than is done for traditional Medicare beneficiaries, making Medicare Advantage enrollees look sicker and increasing payments from the federal government.

Analysis of Medicare Advantage insurers’ coding practices consistently finds that chart reviews, which are not used in traditional Medicare, are the largest contributor to higher payments, resulting in an estimated $24 billion in additional Medicare Advantage payments in 2023. More specifically, these are diagnoses added from chart reviews that are not otherwise documented in encounter data reported by health care providers. In response to concerns about the higher costs associated with more intense coding in Medicare Advantage than in traditional Medicare, policymakers have debated changes to how payments are adjusted for enrollees’ health status. For example, the No UPCODE Act would prohibit the inclusion of diagnoses included only on a chart review record from being considered for risk adjustment purposes, among other changes.

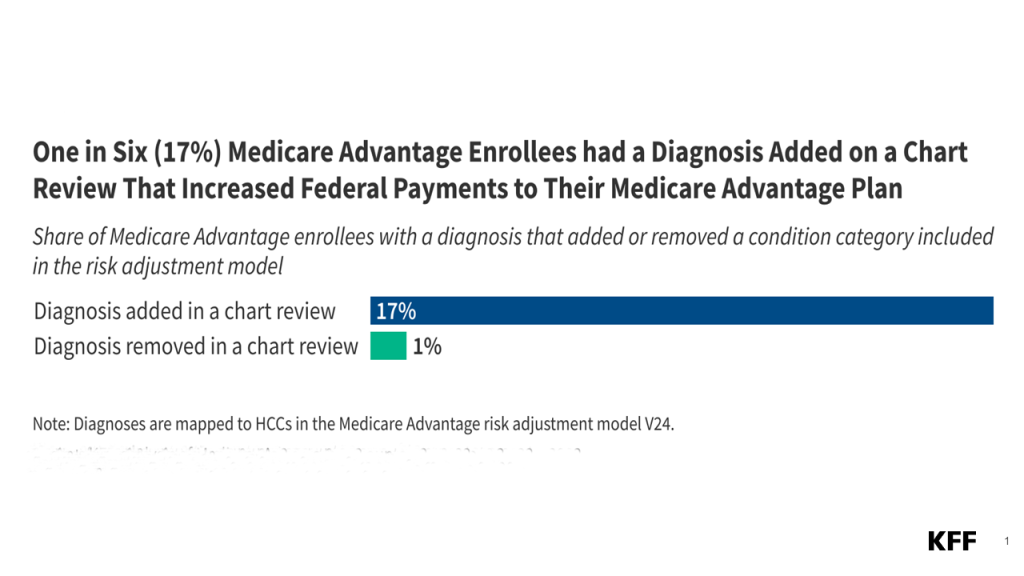

Using Medicare Advantage encounter data for 2022 (see Methods Box), this analysis finds that six in ten (62%) Medicare Advantage enrollees have at least one chart review record and that diagnoses added from chart reviews increase payments from CMS to Medicare Advantage insurers for one in six (17%) Medicare Advantage enrollees. The use of chart reviews varies across the largest Medicare Advantage insurers.

More than six in ten (62%) Medicare Advantage enrollees had at least one chart review record.

Across the 29 million Medicare Advantage enrollees, more than six in 10 (62%) or about 18 million people, had at least one chart review record in 2022 (Figure 1). Insurers conduct a chart review by examining a person’s medical records, sometimes by using AI tools, to determine if they are consistent with the information submitted by the provider to the insurer. By examining medical records, insurers can determine if there are any additional diagnoses that may impact a person’s health status. That information can both improve the insurer’s understanding of a person’s health care needs and increase the payments they receive by increasing the person’s risk score and thus predicted costs. However, chart reviews can also identify diagnoses that are inaccurate, no longer an active consideration, or unrelated to the clinical care enrollees receive, and thus potentially inappropriate to submit to CMS for payment purposes.

It is far more common for diagnoses to be added than removed as part of a chart review record.

Across all Medicare Advantage insurers, nearly one in six (17%) enrollees had at least one diagnosis on a chart review record that resulted in an additional condition category being added that affected the person’s risk score but did not appear on any encounter records submitted by providers (Figure 2). Among the 18 million enrollees with at least one chart review, about 30% had a diagnosis added from a chart review that increased the federal payment to the Medicare Advantage plan.

The most common conditions added from a chart review contributed substantially to Medicare payments to private insurers. MedPAC found that 8 conditions added at least $1 billion each to Medicare payments to private insurers as a result of chart reviews. These conditions comprised about half of the additional conditions identified in this analysis and include vascular disease; chronic obstructive pulmonary disorder; diabetes with chronic complications; major depressive, bipolar, and paranoid disorders; congestive heart failure; disorders of immunity; morbid obesity; and rheumatoid arthritis and inflammatory connective tissue disease.

The absence of the diagnoses on encounter records means there is no evidence that the enrollee received any medical care related to the condition. This analysis did not examine whether someone had a prescription drug claim for a condition added on the chart review but not in an encounter record, so it is possible that someone was taking medication related to the condition. However, when a provider prescribes medication, they generally record a diagnosis in the record of the encounter for the evaluation and management service (office visit) where the decision to prescribe the medication was made.

In contrast, just over 1% of all Medicare Advantage enrollees had at least one chart review that deleted a diagnosis that resulted in a condition category being removed for risk adjustment purposes. Diagnoses may be deleted when the chart review finds no information in the medical record to support the inclusion of the condition. Removing a diagnosis, when appropriate, would increase the accuracy of information reported to Medicare, and also result in reduced payments to plans by removing conditions the enrollee does not have that would otherwise increase risk scores.

While chart reviews can be used to both add and remove diagnoses, the far more common outcome is additional diagnoses. The Department of Justice is currently pursuing or has recently settled litigation against several Medicare Advantage insurers alleging that they used the chart review process to add diagnoses to increase risk adjustment payments from CMS, but did not remove invalid diagnoses using the same process, and thus received unjustified payments from the Medicare program.

The share of enrollees with a chart review record varied substantially across the largest insurers.

Among the Medicare Advantage insurers with the highest enrollment (at least 500,000 enrollees), a larger share of enrollees in plans sponsored by CVS Health Corporation (86%), Elevance Health Inc. (82%), UnitedHealthcare (77%), and Centene (73%) had a chart review record compared with enrollees in plans sponsored by Humana Inc. (34%) and Kaiser Foundation Health Plan (27%) (Figure 3). The variation likely reflects different approaches to collecting and verifying information about enrollees’ health status. For example, some Medicare Advantage insurers also use health risk assessments to collect information about diagnoses and often offer enrollees rewards and incentives for completing them. The differences across insurers could also reflect varying capacities to invest in tools and processes to conduct chart reviews, or the use of more targeted reviews by certain insurers.

Across the largest insurers, more enrollees had a diagnosis added than removed as part of a chart review record.

More than 20% of enrollees in plans sponsored by Centene (26%) and UnitedHealth Group (23%), and 19% of enrollees in plans sponsored by CVS Health Corporation and Elevance Health Inc., had at least one diagnosis in a chart review that increased their risk score and the payment the insurer received from Medicare. A smaller share of enrollees in Humana (9%) and Kaiser Permanente (4%) plans had a diagnosis added on a chart review that did not appear elsewhere in their record of encounters for medical services and thus increased the insurer’s payment from the federal government. In total, UnitedHealth Group, while not the most likely of insurers to add a diagnosis during chart reviews, enrolls nearly 30% of all beneficiaries in a Medicare Advantage, and so likely contributes more than others to the higher spending associated with chart reviews.

Across the largest insurers, with the exception of Kaiser Permanente, fewer than 1% of enrollees had a chart review that deleted a diagnosis and removed a condition for risk adjustment purposes. The rates of removing conditions were lower for these insurers than the overall rate among all Medicare Advantage enrollees, suggesting that smaller insurers more frequently removed diagnoses using chart reviews, though it is still an uncommon outcome. Just under 4% of Kaiser Permanente enrollees had a diagnosis removed on a chart review.

Methods

This analysis uses the Medicare Advantage encounter data 20% sample in 2022. Encounters across all service types—inpatient, outpatient, carrier, home health, and skilled nursing facility—are included. Durable medical equipment encounters are excluded. The analysis does not incorporate Part D prescription drug event data, which provides information on fills of prescription drugs because (these data are not included in the risk score model).

Chart reviews are identified using the Chart Review Switch in the encounter data. Removals of diagnoses are identified using the Claim Medical Record Number. Instances where an insurer replaces an entire encounter record through a chart review are not included in this analysis. A diagnosis is considered to be an addition if it does not appear on any other encounter record, including those identified as including a health risk assessment. Diagnoses are mapped to condition categories using the non-ESRD V24 risk score model.

The 20% sample is random but not distributed based on actual enrollment in Medicare Advantage plans. To more accurately estimate the number of chart reviews by insurer, we created weights based on the number of enrollees in plans sponsored by each insurer that appear in the 20% sample compared to the total number of enrollees in plans sponsored by the Medicare Advantage insurer in March of 2022.

Note:

This work was supported in part by Arnold Ventures and AARP. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.