(Bloomberg) — Citigroup Inc.’s wealth chief says the equity bull market still has “some room to run” as the Wall Street giant is luring record inflows from rich clients this year.

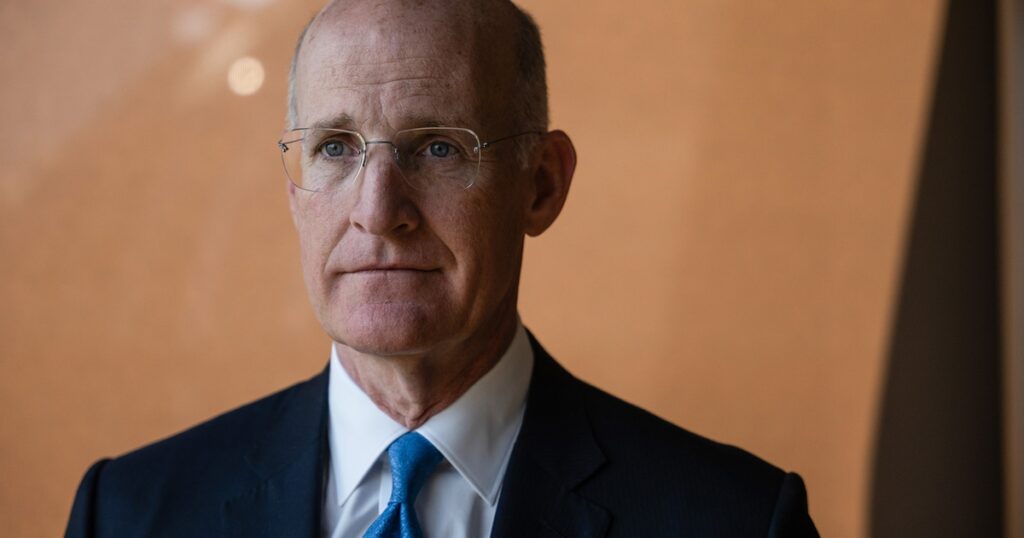

“There’s not exuberance, and there’s not the kind of behavior that you see in the late stage of a bull market where investors are, you know, throwing money at stocks,” Andy Sieg said in an interview last week from Hong Kong.

The S&P 500 is down about 2% in November, on pace for its worst month since March, while volatility has surged. A selloff in the world’s largest technology companies has reignited debate over AI and valuations. A rally late Thursday after an upbeat forecast from technology bellwether Nvidia Corp. later fizzled, though US stocks rebounded Friday.

The bank doesn’t see a “turning point” in the market, as earnings expectations remain strong, Sieg said. Wealthy clients still have cash on the sidelines and are focused on entering the market with downside protection through products such as structured notes, he said.

Sieg joined from Bank of America Corp. in 2023 to overhaul Citigroup’s broader wealth business, a key part of Chief Executive Officer Jane Fraser’s plans to boost returns. The bank’s wealth unit is much smaller than similar divisions of Wall Street peers such as Morgan Stanley and JPMorgan Chase & Co.

Under his watch, the unit has shifted focus from a lending-heavy private bank to handling more investments. Client investment assets were up about 14% in the third quarter from a year earlier. New inflows, meanwhile, reached $37.1 billion for the first nine months of the year, including a record haul in the third quarter, according to financial statements.

Asia has been particularly strong, with record inflows in the third quarter. As a result, bonuses for private bankers in the region will be up, Sieg said, declining to provide any figures.

“Our net client inflows in Asia are the strongest that we see anywhere,” he said from the bank’s Champion Tower office in Hong Kong.

Fraser has been overseeing a significant revamp of the bank — including cutting 20,000 jobs — in an attempt to shed its laggard reputation on Wall Street. Citigroup remains the only major bank to trade below book value, meaning investors consider it to be essentially worth less than the sum of its parts.

In recent years, the New York-based lender exited consumer banking in some Asia markets, including China, India and Taiwan, as part of the retrenchment, prompting questions around further exits.

Sieg said that the bank is “100% committed” to the Citigold business in Asia, which targets clients with about $200,000 in assets. The firm has no plans to sell it, he said.

Read More: Citi CFO Mason to Step Down as Fraser Shuffles Businesses

Last week, the lender also announced plans to fold its retail bank into the wealth business, creating a single group to be led by Kate Luft. She will take on a new title as head of US retail banking and Citigold, reporting to Sieg.

In Hong Kong and Singapore, the bank’s two main Asia wealth hubs, clients from China are “really powering the growth.” For India, the bank is seeing flows from non-resident Indians in Singapore, Dubai and London, and has no plans to expand onshore, according to Sieg.

After a recent visit to Beijing and Shanghai, Sieg noted a “level of energy” around economic development in China not seen since pre-Covid. He said the bank feels “very good” about its China business.

Read More: Citi Investigated HR Complaints Against Wealth Head Sieg

Sieg has also faced obstacles, including claims of intimidating colleagues, which triggered an investigation by outside law firm Paul Weiss, Bloomberg reported in August. Fraser told Bloomberg Television in September that she is “comfortable” with the findings of the internal probe.

The stories “are not an accurate reflection of my leadership style or the culture of our wealth business,” said Sieg. “Change is hard, and we have had a massive change.”