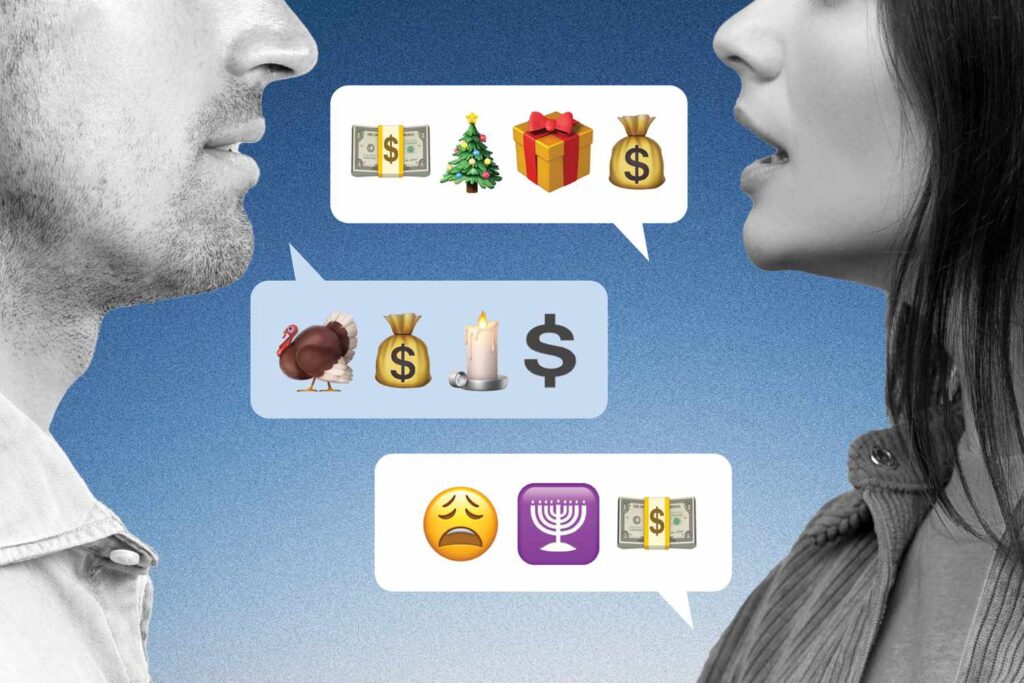

Conversations about money with loved ones can be downright awkward, especially around the holiday season. While it might seem easier to avoid the topic, being honest and transparent with loved ones might actually be better for your relationships.

Investopedia spoke with Gerika Espinosa, a certified financial planner (CFP) and certified financial therapist at DMBA Financial Planning, to discuss how to can establish boundaries with family members, have tough conversations, and mentally prepare for spending big on Black Friday.

The key, Espinosa said, is to be “extra intentional” in the face of pressure to spend big around the holidays to make people happy even if that isn’t a goal of yours.

Here are edited excerpts from that conversation.

Investopedia: During the holidays, people typically spend more money—whether it’s on gifts or flights to see friends and family. How can people set boundaries around their spending and communicate them with their loved ones?

Espinosa: As far as gift-giving goes, some [of my] clients are not in the best financial situation. We talk about setting expectations with their kids way before Christmas even happens, like [by saying] ‘Hey, we’re going to scale down a little bit this year.’ When our expectations are met, things are just fine. Usually, when there’s a surprise, it kind of throws off the equilibrium and everyone gets upset.

As far as travel is concerned—if there’s flights involved, I would encourage people to have conversations before the holidays, like summertime. [That way] you can start preparing to save monthly for those flights. Sometimes the conversation with families [may include] ‘If we’re traveling, we might not be able to bring gifts. Could you help us out with Christmas gifts or the flights?’

Whatever your situation is, the holidays are not an excuse to just [ignore] the budget and do whatever you want.

Investopedia: What are some mistakes that people should avoid making when having conversations about money with their loved ones?

Espinosa: I think sometimes people choose not to be transparent [enough]…. Sometimes people associate gifts with love while other people don’t. It’s important to understand how much weight it actually carries with your loved ones.

Make sure you convey [your situation] transparently and appropriately [by saying] ‘This is our financial situation. We have goals that we’re working on to get out of debt.’

Usually, when you share you’re trying to get out of debt or build up savings, almost everyone is understanding and willing to support.

Investopedia: For people who struggle with overspending on Black Friday or during the holidays, what type of advice would you give them?

Espinosa: We need to buy things that are important to us and fit within our values. Buying things just because they’re good deals does not save us money. It does the opposite—it makes us spend.

If people haven’t been tracking [prices], they will just assume something is a good deal if it’s 30% off. I always encourage people to check the prices before Black Friday, put it in their cart now, and see what that cost is. Then, when Black Friday comes, they’re going to know if it’s a good deal. By knowing the [current] price, they can expect it in their budget.

Because Black Friday is at the end of the month, prep for that whole month. When you want to spend, you say ‘I’m saving this [money] for Black Friday.’ You’re making a trade-off, and that’s more powerful—[you’re] sacrificing something better for the future, instead of just withholding and denying yourself privileges.