I’m on The Finance Girlies podcast today!

I met Cassidy and Emily at Fincon, and we hit it off right away. They run a podcast together called The Finance Girlies, and they asked if I would be a guest.

I always feel like I’m a little better at communicating by typing than talking (You can edit what you type! You never have to type, “um” while you are thinking!) but we had a fun conversation talking about grocery budgeting, Christmas spending, and more.

Click here to listen to the episode.

And here’s where you can subscribe to their Substack newsletter (there is a free option!)

What’s one of your earliest frugal memories?

In the interview with the Finance Girlies, they asked me how I started to be frugal, and I said I think maybe I was born this way.

As a kid, I remember attaching the last bit of a bar of soap to the new one, even though I wasn’t buying the soap!

I still do this!

I sent away for free cross-stitch patterns using little postcard offers from magazines.

And I remember one time I sent away for a free ceramic tart dish with roses on it; I felt especially triumphant about that one.

I’m curious if you guys have similar stories of early-onset frugality. 😉

A hospital staff thank-you gift idea

Sometimes, the families of patients bring in a thank-you gift for the staff (flowers, a cake, etc.) but I wanted to tell you about my favorite one so far: a large square basket filled to the brim with individual packets of snacks: granola bars, nuts, cookies, fig newtons, and so on.

I loved this because it was so easy to walk by, grab a packet, and stash it in a pocket for a snack (to be eaten when you get a spare minute).

Donuts, cookies, or cakes are nice too, but they are not as portable!

Another benefit of the individual packets: they’re great for sanitary purposes in a hospital; even the most germophobic staff members are happy to grab a packet of nuts or crackers.

If you shopped at a warehouse club, I bet that the big basket of snacks is actually cheaper than some things people bring in, such as a big box of Crumbl cookies.

I hope that you and your loved ones don’t have to visit a hospital! But if you do, and you want to bring in a thank-you gift, I give the snack basket a 10/10 rating. 🙂

Do you wonder if you will be the only one?

Back when breast augmentation surgery was becoming extremely popular (late 1990s/early 2000s), I started to wonder if I would one day be one of the only people on the planet without one.

That has not turned out to be the case. Actually, there are quite a few people who are getting theirs taken out and are embracing their natural shape/size.

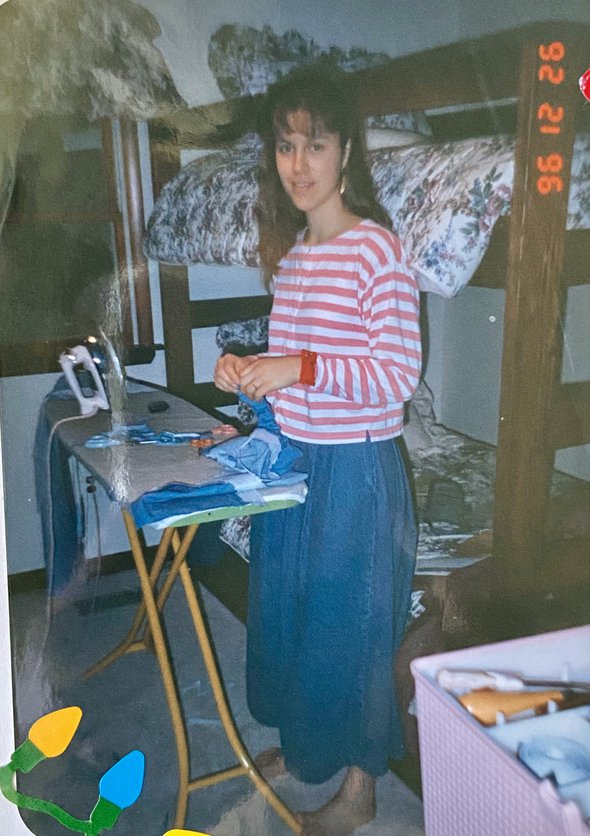

Guess who was never destined to be curvy? THIS GIRL! (1996 Kristen)

Lately, though, I have noticed that social media is making me wonder if I am going to be one of the only people on the planet without Botox or fillers.

I mean, even people in their 20s are getting Botox as a preventative. My children are the target market for that!

And I realized this is the same feeling I had back when I was a young adult.

I know that getting a breast augmentation and getting Botox/fillers are both morally neutral things. But, I think what bothers me are the underlying expectations that drive these industries.

There’s this idea that we are all supposed to look a certain way; that we all need to be curvy above and below, but with a tiny waist, and that we need to avoid aging at all costs.

I’m not placing blame on individual women for this; sadly, it is true that women are treated more poorly if they show signs of age. I can’t fault people for playing the game.

(Paulina Porizkova, a 61-year old model, talks about this a lot, even though she is someone who is still so beautiful. She says when you age, you get relinquished to the Invisible Woman category.)

Happily, I do see lots of pushback on the pressure to dye our gray hairs; there’s a whole crop of gray hair influencers on Instagram, in fact!

So maybe one day we will learn to accept our wrinkles as well. Perhaps we will even have wrinkle influencers. 😉

For the record: Even though I do wholeheartedly embrace the idea of aging being natural and good, and even though I dislike the cultural pressure that’s put on us….this aging stuff is still sometimes a little bit hard for me.

I do not love my gray hairs.

I do not love it when I see crepey skin on my neck in photos.

I do sometimes feel nervous about the fine lines that are forming on my face, and I wonder what my face will look like in 10 or 20 years.

But I’m trying to at least make peace with all of those things and remind myself:

- Aging is a privilege

- Youthful does not equal more valuable

- My appearance is one of the least important things about me

- My heart, the essence of who I am, will still be the same, no matter what I look like

Annnnd I also remind myself that I am saving piles of money by letting my face and hair do their thing.

Ok! As always, any miscellany topic is up for discussion: early-onset frugality, healthcare worker gifts, and aging interventions!

P.S. If you do get Botox or fillers or you dye your gray hair: it is perfectly ok. I’m not trying to make you wrong for it, and you don’t need to justify it to anyone, including me.

P.P.S. I realize that I am not even 50 yet, so my worries about aging probably sound very silly to those of you who are in your 60s or 70s. But they are still true, and maybe someone who is my age needs to know that I also feel a little uncomfortable with my gray hairs. 🙂