KEY TAKEAWAYS

- The “One Big, Beautiful Bill” created different student loan limits for graduate students and “professional” graduate students.

- Professional students, such as those in medical and law fields, will receive a higher loan limit than other graduate students.

- Critics argue that excluding degrees such as nursing and social work from being considered “professional” makes it more difficult for students to afford their master’s degrees.

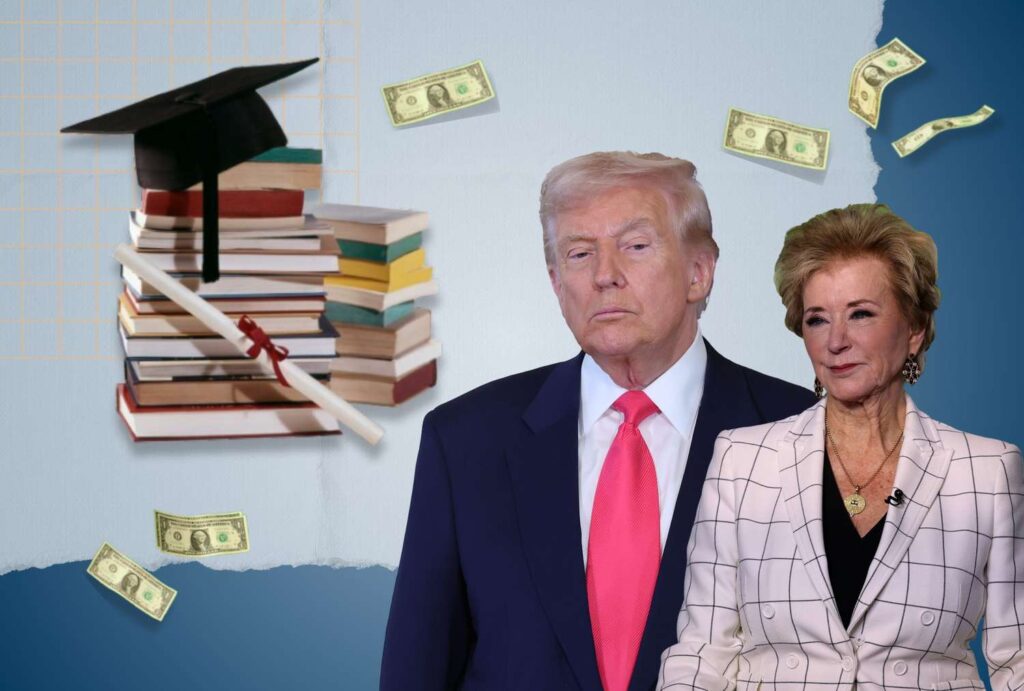

A new classification could make it harder for some graduate students to afford their degrees.

The “One Big, Beautiful Bill” Act, passed in July, directed the Department of Education to reduce the amount of student loans available to many graduate students.

Previously, all graduate students had an aggregate student loan cap of $138,500. Starting July 1, 2026, graduate students will be limited to a total of $100,000 in loans, but graduate students in professional degree programs will have their cap increased to $200,000.

The Department of Education recently defined which graduate students are considered ‘professional.’ Degrees such as medicine, law, and pharmacy were considered professional degrees, while nursing, social work, and engineering programs were not included in the classification.

The bill also eliminated Graduate PLUS loans, which graduate students have typically used when they had reached the limit of unsubsidized and subsidized loans offered to them. That’s led some graduate students, especially in nursing, to argue that it will be more difficult to afford their education.

The Department of Education Says It Did Not Exclusively Omit Nursing Students

The Department of Education pushed back on Monday, stating that most graduate students, particularly those in nursing, will not face issues with the new loan limits. The department also said that the majority of nurses do not hold a graduate degree, and its decision on which degrees are considered professional was not made to exclude nursing degrees specifically.

“Placing a cap on loans will push the remaining graduate nursing programs to reduce their program costs, ensuring that nurses will not be saddled with unmanageable student loan debt,” the department’s statement said.

Currently, about 136,656 students are enrolled in a master’s-level nursing program, according to data from the American Association of Colleges of Nursing.

A master’s degree in nursing typically takes two to three years to complete. Given the average amount of federal student loans a graduate student takes, a master’s nursing student would take out $35,420 to $53,130 in federal student loans, according to 2025 numbers from the College Board. That’s in addition to the roughly $15,000 average cost of an undergraduate degree, according to the College Board.

In total, a graduate nursing student is likely to borrow between $50,580 and $68,290 on average. However, costs vary widely depending on whether the program is public or private and whether the student attends an in-state or out-of-state college.

Nursing master’s degrees, among others, were never explicitly considered a “professional” degree. In the initial language from the Higher Education Act of 1965, the list of professional graduate programs “includes but is not limited to” pharmacy, dentistry, veterinary medicine, chiropractic, law, medicine, optometry, osteopathic medicine, podiatry, and theology.

Who Else Is Affected?

Under the proposed language, there will be 11 different graduate degrees considered ‘professional’ and will not be subject to the lower limit. Students getting a graduate degree that isn’t on the list will be subject to the $100,000 limit.

The Professional Graduate Degrees

Pharmacy (Pharm.D.)

Dentistry (D.D.S. or D.M.D.)

Veterinary Medicine (D.V.M.)

Chiropractic (D.C. or D.C.M.)

Law (L.L.B. or J.D.)

Medicine (M.D.)

Optometry (O.D.)

Osteopathic Medicine (D.O.)

Podiatry (D.P.M., D.P., or Pod.D.)

Theology (M.Div., or M.H.L.)

Clinical Psychology (Psy.D. or Ph.D.)

In the proposed language from the Department of Education during a November rulemaking session, clinical psychology degrees were added to the list of professional degrees.

This language is still a proposal and may be revised; the public will have an opportunity to provide comments as the department finalizes the rule early next year.