Summary

The Department of Homeland Security (DHS) released a proposed rule that would rescind 2022 Biden-era public charge determination regulations. In their place, DHS plans to provide interpretive and policy tools to guide public charge determinations and suggests it will “move away from a bright line primary dependence standard” and remove limitations on the types of public resources that are relevant for considering. As such, immigration officers would be given broad discretion to make determinations and could consider programs previously excluded from determinations, including Medicaid and the Children’s Health Insurance Program (CHIP), as well as potentially a much broader array of health and other support programs, other types of assistance, and family members’ use of programs. Under longstanding immigration policy, federal officials can deny entry to the U.S. or adjustment to lawful permanent resident (LPR) status (i.e., a “green card”) to someone they determine is likely at any time to become a public charge.

The proposed public charge changes along with other Trump administration policy changes will likely lead to decreased participation in public programs, including Medicaid and CHIP, among a broad group of immigrant families, including citizen children in those families. DHS indicates that the rule will deter immigration to the U.S. and reduce the number of immigrants relying on public programs. DHS further notes that the “elimination of certain definitions may lead to public confusion or misunderstanding of the proposed rule, which could result in decreased participation in public benefit programs by individuals who are not subject to the public charge ground of inadmissibility.” Research suggests that such “chilling effects” will likely lead to disenrollment and forgone enrollment among a broader group of individuals living in immigrant families than those subject to public charge determinations, including citizen children in these families. These fears may be further amplified by a recent notice from the Centers for Medicare and Medicaid Services (CMS) that it will begin sharing data it receives from states with Immigration and Customs Enforcement (ICE). Moreover, these changes come as immigrant families are already experiencing starkly increased fears due to President Trump’s immigration policies, leading them to limit their activities and participation in assistance programs and as recently passed legislation will make fewer lawfully present immigrants eligible for federally-funded health coverage programs.

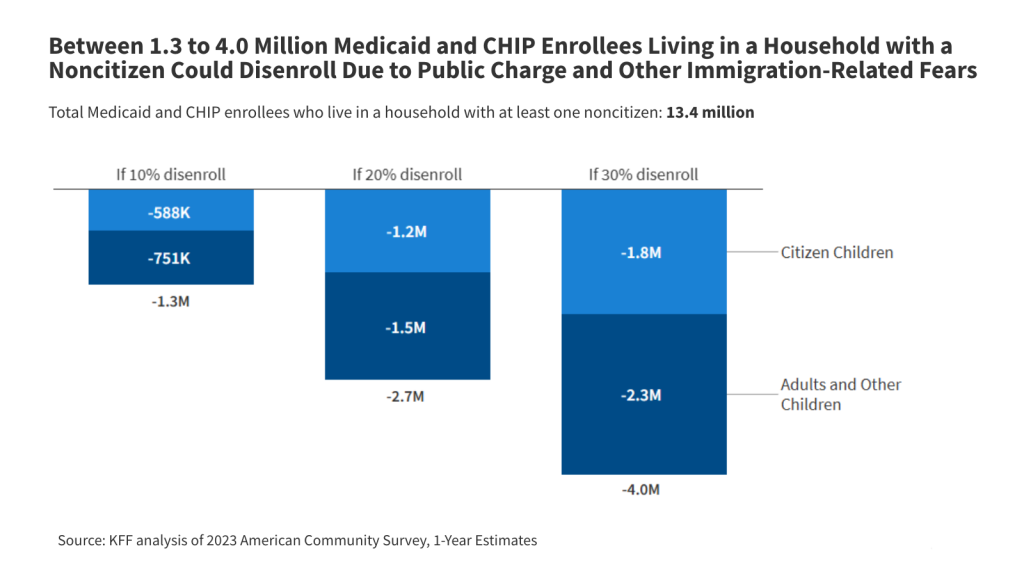

If the proposed rule leads to disenrollment rates ranging from 10% to 30%, between 1.3 million to 4.0 million people could disenroll from Medicaid or CHIP, including nearly 600,000 to about 1.8 million citizen children. Additionally, assuming the same forgone enrollment rates, between about 200,000 to 500,000 uninsured people could forgo enrolling in Medicaid or CHIP despite being eligible, including over 50,000 to more than 150,000 citizen children. According to KFF analysis of American Community Survey (ACS) data, there are about 13.4 million Medicaid or CHIP enrollees living in a household with at least one noncitizen, including 5.9 million citizen children, who may be at risk for decreased enrollment. Additionally, nearly 1.8 million uninsured individuals are eligible for Medicaid and CHIP but are not enrolled and are living in a household with a noncitizen, including over 500,000 citizen children. These estimates differ from DHS estimates in the proposed rule (see Methods for more). Beyond Medicaid and CHIP, fear and confusion would likely have similar effects on participation in other programs, especially since DHS suggest it will give officers broad discretion to consider use of all sources of public resources in public charge determinations.

The proposed rule will likely lead to coverage losses and contribute to negative health outcomes, increases in uncompensated care, and broader negative spillover effects on communities and the workforce. Overall, the proposed rule would likely lead to reductions in health coverage, nutrition assistance, and other sources of support among immigrant families, including citizen children in those families. Nationally, one in four children live in a family with at least one immigrant parent. Reduced participation in health coverage and other assistance programs would negatively affect the health and financial stability of immigrant families and the growth and healthy development of their children. In addition, coverage losses would lead to lost revenues and increased uncompensated care for providers and have broader spillover effects within communities and on the workforce. DHS notes that the proposed rule may lead to worse health outcomes; increased use of emergency rooms; higher prevalence of communicable diseases; increases in uncompensated care; and increased poverty, housing instability, reduced productivity, and lower educational attainment. It also recognizes that it may result in reduced revenues for certain health, food, and housing providers.

Background

Under longstanding immigration policy, federal officials can deny entry to the U.S. or adjustment to lawful permanent resident (LPR) status (i.e., a “green card”) to someone they determine is likely at any time to become a public charge. DHS regulations apply to public charge determinations for individuals seeking adjustment to LPR status within the U.S. Separately, media reports indicate new Department of State guidance directs visa officers to consider a wide range of health conditions when reviewing applications to enter the U.S. Under statute, officers must, at a minimum, consider age; health; family status; assets, resources, and financial status; and education and skills in making public charge determinations. Some groups, such as humanitarian immigrants, are exempt from public charge determinations under statute.

In 2022, the Biden administration published public charge regulations largely to address chilling effects of a 2019 Trump administration rule that led many immigrant families to avoid seeking health coverage and other services and assistance for which they were eligible. During his first term, President Trump implemented public charge rules that had newly considered the use of noncash assistance programs, including Medicaid, in public charge determinations. These changes led many immigrant families, including citizen children in these families, to forgo assistance and services for which they were eligible, including health coverage and care. In 2021, the Biden administration stopped applying the rule and reverted to prior 1999 field guidance. It subsequently published regulations in 2022 that largely codified the 1999 field guidance. The 2022 regulations defined a public charge as someone who is likely to become primarily dependent on the federal government as demonstrated by the use of cash assistance programs for income maintenance or government-funded institutionalized long-term care. The rule specifically excluded the consideration of noncash programs, including Medicaid (except for long-term institutionalization) and CHIP, from public charge determinations. It also prohibited the consideration of other family members’ use of programs. The 2022 regulations remain in effect until a new rule is finalized.

The proposed rule would rescind the 2022 public charge regulations (other than a provision related to bonds) and provide broad discretion to immigration officers in making public charge decisions, including considering factors and use of programs that had been excluded. DHS plans to provide interpretive and policy tools to guide public charge determinations if the proposed rule is finalized. In the preamble to the proposed rule, DHS notes that both the 2019 and 2022 rules were overly restrictive in providing narrow and finite lists of public benefits that could be considered as part of the public charge determinations and in not expressly providing officers with the authority to consider other factors beyond those specified in the rules. DHS suggests that eliminating the 2022 rule will allow for consideration of “receipt of any type of public benefits.” DHS proposes it will “move away from a bright line primary dependence standard” and remove limitations on the types of public resources that are relevant for consideration. As such, immigration officers would be given broad discretion to make determinations and could consider programs previously excluded from determinations, including Medicaid and CHIP, as well as potentially a much broader array of health and other support programs, other types of assistance, and family members’ use of programs.

Beyond the proposed changes to public charge, the Trump administration has implemented an array of immigration policy changes that have significantly increased fear among immigrant families, making them more reluctant to participate in activities or use services. The KFF/New York Times 2025 Survey of Immigrants shows that immigrant adults report rising fear and negative economic and health impacts amid this environment. More than one in five (22%) immigrant adults say they personally know someone arrested, detained, or deported for immigration-related reasons since January 2025, and 41% worry they or a family member could be detained or deported. Three in ten (30%) say they or a family member have limited their participation in activities outside the home since January due to concerns about drawing attention to someone’s immigration status, and 29% report skipping or postponing health care in the past 12 months, with 19% of this group (5% of all immigrant adults) citing immigration-related worries.

Past Evidence of “Chilling Effects”

Research indicates that the 2019 Trump administration public charge policy changes contributed to disenrollment from Medicaid and CHIP and other programs among immigrant families, including citizen children in these families. Analysis finds that between 2016 and 2019, the share of children receiving Medicaid, the Supplemental Nutrition Assistance Program (SNAP), and Temporary Assistance for Needy Families fell about twice as fast among U.S.-citizen children with noncitizen household members as it did among children with only citizens in their households. Specifically, the analysis found that participation in Medicaid and CHIP fell by 18% among low-income U.S. citizen children with a noncitizen in the household compared to 8% among their counterparts in citizen-only households. Other studies found larger drops in Medicaid coverage among children in mixed status or noncitizen families compared to those in citizen families between 2017 and 2019 as well as larger declines in SNAP enrollment among noncitizen children and citizen children living in mixed-status families compared to citizen children with U.S.-born parents. Survey data from 2019 found that more than one in seven adults (16%) in immigrant families reported avoiding a noncash government benefit program such as Medicaid or CHIP, SNAP, or housing subsidies for fear of risking future green card status, with the share rising to 26% among adults in low-income immigrant families.

Research also suggests that these fears persisted even after the Biden administration reversed the 2019 public charge policy changes in 2021. The KFF/LA Times Survey of Immigrants showed that, as of 2023, 8% of immigrant adults, rising to over a quarter (27%) of those who are likely undocumented, said they avoided applying for food, housing, or health care assistance in the past year because they didn’t want to draw attention to their or a family member’s immigration status. Other survey data found nearly one in four adults in mixed immigration status families and over one in seven adults in immigrant families with children avoided safety net programs because of concerns related to immigration status in 2023.

As of 2025, there was already an increase in the share of immigrants reporting disenrolling from or avoiding enrolling in assistance programs due to immigration-related fears under the Trump administration prior to the release of the proposed public charge rule. In the KFF/New York Times 2025 Survey of Immigrants, 11% of immigrant adults say they stopped participating in a government program that helps pay for food, housing, or health care since January 2025 because of immigration-related worries, ranging from 4% among those living in a citizen-only household to 18% of those living in a household with a noncitizen. Among those in a household with a noncitizen, the shares reporting stopping participation were 11% for those that do not have a likely undocumented immigrant in the household and 36% for those that include a likely undocumented immigrant (Figure 1). Further, about one in ten (12%) immigrant adults say they avoided applying for such a program in the past 12 months because they did not want to draw attention to their or a family member’s immigration status, ranging from 5% among those living in a citizen-only household to 19% among those living in a household with a noncitizen, including 11% for those that did not report having a likely undocumented immigrant in the household and 42% for those that include a likely undocumented immigrant.

Potential “Chilling Effects” on Medicaid and CHIP Enrollment

It is difficult to predict what actual disenrollment or forgone enrollment rates may be in response to the rule. Few lawfully present immigrants who are subject to public charge determinations are eligible for federally-funded programs, including Medicaid and CHIP. However, fear and confusion about the rule would likely lead to disenrollment and forgone enrollment among a much broader group of individuals living in immigrant families, including citizen children.

To estimate potential effects of the proposed changes to public charge determinations amid the current immigration policy environment on Medicaid and CHIP enrollment, this analysis applied disenrollment rates of 10%, 20%, and 30% to the total number of Medicaid and CHIP enrollees living in a household with at least one noncitizen. To estimate potential forgone enrollment, this analysis applies these same rates to the total number of uninsured individuals who are eligible for Medicaid and CHIP but not enrolled who are living in a household with a noncitizen. Given the uncertainty of disenrollment and forgone enrollment, the rates illustrate a range of potential impacts to account for potential underestimates and overestimates.

The midpoint disenrollment and foregone enrollment rate of 20% is based on experiences reported in the KFF/New York Times 2025 Survey of Immigrants. It reflects the share of immigrant adults living in a household with a noncitizen who say they stopped participating in a program that helps pay for food, health care, or housing in the past year due to fears of drawing attention to their or a family member’s immigration status. The share reporting avoiding applying for programs (i.e., forgone enrollment) was similar. The lower bound of 10% reflects the disenrollment and forgone enrollment rate DHS uses to estimate transfer payments in the proposed rule. The upper bound accounts for potential increased effects relative to the experiences reported in the survey due to subsequent policy changes, including the public charge proposal and CMS notice of plans to share Medicaid data with ICE, that were released after the survey was fielded, as well as continued public enforcement activity, which may deter participation.

According to KFF analysis of ACS data, there are about 13.4 million Medicaid or CHIP enrollees living in a household with at least one noncitizen, including 5.9 million citizen children, who may be at risk for decreased enrollment. If the proposed rule leads to disenrollment rates ranging from 10% to 30%, between 1.3 million to 4.0 million Medicaid and CHIP enrollees who are living in a household with at least one noncitizen would disenroll (Figure 2). This includes nearly 600,000 to about 1.8 million citizen children. Beyond potential disenrollment, the proposed rule may also deter new enrollment among the nearly 1.8 million uninsured individuals who are eligible for Medicaid and CHIP but not enrolled and are living in a household with a noncitizen, including over 500,000 citizen children. Assuming a forgone rate between 10% and 30%, between about 200,000 to over 500,000 uninsured individuals who are living in a household with at least one noncitizen could forgo enrollment in Medicaid despite being eligible. This includes over 50,000 to more than 150,000 citizen children.

These estimates differ from DHS estimates in the proposed rule. DHS estimated that 3.5 million Medicaid enrollees and approximately 600,000 CHIP enrollees lived in a household with at least one person who is not a citizen, for a combined total of 4.1 million Medicaid and CHIP enrollees. DHS expects about 400,000 Medicaid and about 60,000 CHIP enrollees to disenroll or forgo enrollment (see Methods for more information).

Methods

The findings presented in this brief are based on KFF’s analysis of the 2023 American Community Survey 1-year Public Use Microdata Sample. KFF classified individuals as not having citizenship, or noncitizens, by their self-reported status at the time of the survey interview. This excludes foreign-born individuals who obtained U.S. citizenship through naturalization.

The 2023 data show that approximately 13.4 million Medicaid/CHIP enrollees were noncitizens or living in a household with at least one noncitizen. Households were classified as having at least one noncitizen if any household member reported not having citizenship. In addition, KFF identified 1.8 million uninsured individuals who are eligible for Medicaid or CHIP but not enrolled and live in a household with a noncitizen. KFF applied its health care coverage eligibility model to identify individuals who are eligible for Medicaid/CHIP but are not enrolled. For more details on the model, see the following explanation.

To estimate potential changes in coverage due to public charge policies, KFF considered disenrollment and forgone enrollment rates of 10%, 20%, and 30%. Results were disaggregated by age and citizenship, with children defined as individuals under age 18. The midpoint disenrollment and foregone enrollment rate of 20% is based on experiences reported in the KFF/New York Times 2025 Survey of Immigrants. It reflects the share of immigrant adults living in a household with a noncitizen who say they stopped participating in a program that helps pay for food, health care, or housing in the past year due to fears of drawing attention to their or a family member’s immigration status. The share reporting avoiding applying for programs (i.e., forgone enrollment) was similar. The lower bound of 10% reflects the primary disenrollment and forgone enrollment rate DHS uses to estimate transfer payments in the proposed rule. The upper bound accounts for potential increased effects relative to the experiences reported in the survey due to subsequent policy changes, including the public charge proposal and CMS notice of plans to share Medicaid data with ICE, that were released after the survey was fielded as well as ongoing public enforcement activity, which may further deter participation.

This method differs from the method applied by DHS in the proposed rule to estimate potential federal and state transfer costs due to disenrollment from Medicaid and CHIP and other programs. In the 2025 proposed public charge rule, DHS estimated that 3.5 million Medicaid enrollees and approximately 600,000 CHIP enrollees lived in a household with at least one person who is not a citizen, for a combined total of 4.1 million Medicaid and CHIP enrollees. DHS expects about 400,000 Medicaid and about 60,000 CHIP enrollees to disenroll or forgo enrollment. To reach this estimate:

- DHS used a six-year average from FY 2019 to FY 2024 to find the average annual number of Medicaid and CHIP enrollees, limiting Medicaid enrollment to adults. Each annual total was calculated by averaging monthly Medicaid or CHIP enrollment over the year.

- DHS then estimated the number of households with Medicaid or CHIP enrollees by dividing the average annual adult Medicaid (44 million) or CHIP (7 million) enrollment by the average U.S. household size (2.54) in 2023.

- DHS multiplied the share of the total U.S. population that is foreign born (6.61%) times the number of households with Medicaid or CHIP enrollees to calculate their estimate of enrollee households with at least one noncitizen.

- Lastly, DHS then multiplied these households by the average size of foreign-born households (3.12) to finally estimate the number of Medicaid or CHIP enrollees living in a household with at least one noncitizen. DHS applied a 10.3% disenrollment and forgone rate to the approximately 3.5 million Medicaid and 600,000 CHIP enrollees.