Key Takeaways

- A recent study by MovingPlace.com found that the states where homes are more likely to have issues, such as foundation damage, faulty plumbing, and electrical problems that could go undetected during the buying process.

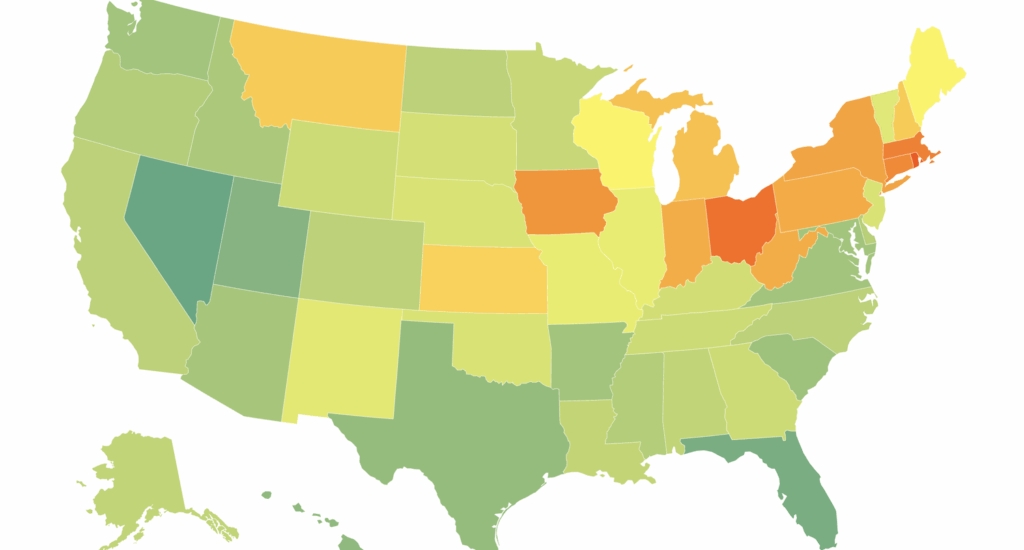

- Rhode Island, Ohio and Massachusetts led the states with potential ‘lemon’ homes, while Nevada, Florida and Utah were states where homes were likely to have the fewest issues.

- States with a higher proportion of lemon homes were generally in the Rust Belt and suffered from an aging housing stock and harsher weather conditions.

Does the home you’re thinking about buying have hidden problems like water leaks, electrical issues or plumbing problems?

You could be buying a “lemon”—a home with undisclosed problems that can cost owners thousands to address. If you’re in one of the states highlighted in a new study of “lemon” homes, you may want to look closely before you buy.

Why This Matters for Homebuyers

America’s housing stock is older than ever, forcing homeowners to spend billions on repairs collectively. Here’s how to avoid problems before you sign a contract.

Real estate data site MovingPlace.com looked at a variety of common home issues in each state, including the percentage of homes with issues that included the foundation, water intrusion, the electrical system, plumbing, roof and windows.

In compiling that data, the study found that Rhode Island was the state most likely to have homes with hidden problems, followed by Ohio, Massachusetts, Connecticut and Iowa. States where homebuyers had the least risk of finding a lemon included Nevada, Florida, Utah, Hawaii and Texas.

The report found the states leading the list are generally located in the “Rust Belt” region, which comprises aging industrial areas spanning from New York through the Midwest. Overall, houses in these states are generally older, face harsher winters, and in some areas, higher humidity too.

“Overall, buyers and renters in Rust Belt states and metros face a significantly higher risk of encountering a lemon home compared with other regions, meaning anyone looking in these areas should be more careful and aware of common structural and system issues,” the MovingPlace.com study said.

Aging Homes Contribute to the Problem

Other data has also pointed to the growing problem of aging houses in the market. The Harvard Joint Center for Housing Studies found that in 2023, the median age of a U.S. house was 44 years.

It’s part of what is driving housing repair costs higher, a figure that jumped from $404 billion in 2019 to an expected $600 billion through 2025, according to the Harvard study. That report found that maintenance spending on homes built before 1980 was 76% higher than homes built after 2010.

“The housing stock is older than ever, and critical improvements are needed to replace aging components,” the report said.

How to Spot a ‘Lemon’ Home

In order to avoid landing a lemon home yourself, it’s critical to have a home inspection. More than one in five buyers waived a home inspection in September, National Association of Realtors data showed. While it may seem like a quick way to beat the competition in a bidding war, it can lead to big headaches in the future.

In fact, MovingPlace.com also suggests hiring specialty inspectors, such as plumbers or roofers, especially if the home is located in a high-risk area. If the region has a history of bad weather, storms, freezes and floods, it’s especially important to do your due diligence.

Prospective buyers should ask about a home’s repair history, as homes with a more complete set of records of repairs, permits and inspections are less likely to have unforeseen problems.

Finally, just because a home has cosmetic upgrades doesn’t mean there aren’t needed repairs lurking underneath. Homebuyers should keep an eye out for moldy smells, signs of patching or uneven floors for indications of larger problems.