Key Takeaways

-

Mortgage rates recently hit an almost 13-month low before inching higher again, currently averaging 6.48% nationwide.

-

The latest data show Kentucky with the lowest rates, while mortgages were priciest in Hawaii. Our map shows the average in every state.

-

Because rate timing is tough to predict, buyers are often better off purchasing when they’re ready and the right home comes along.

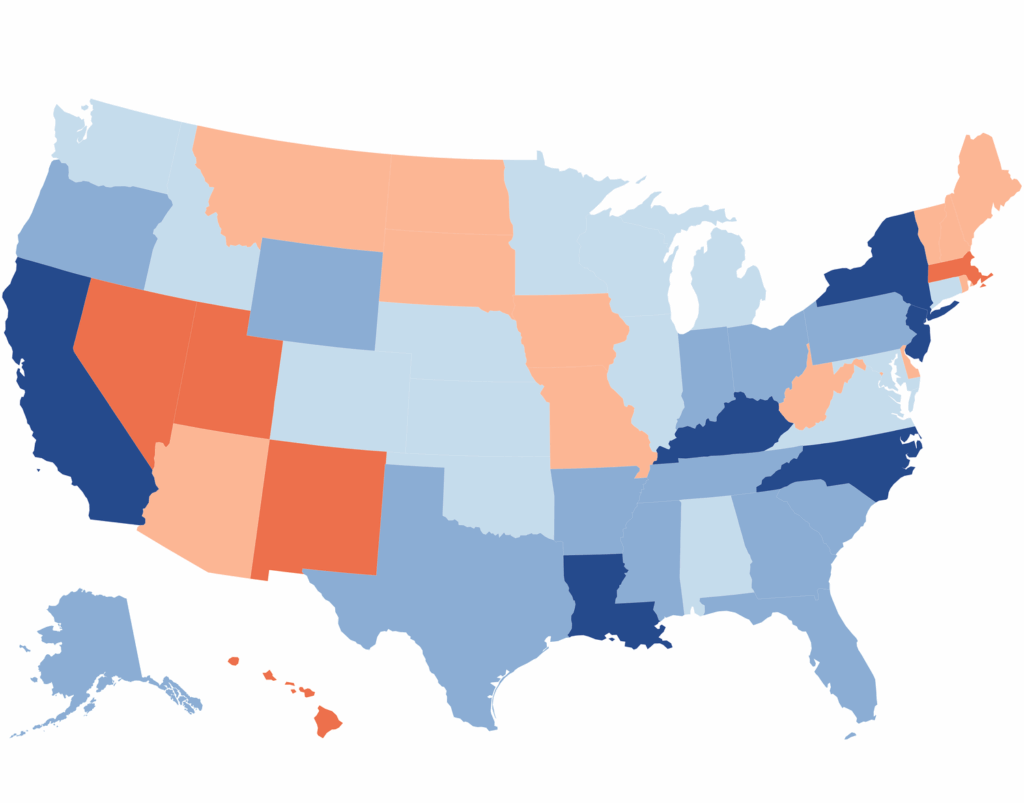

While mortgage rates generally move in the same direction nationwide, some states average slightly higher or lower than others. The states with the lowest 30-year fixed mortgage rates are currently Kentucky, New York, North Carolina, Louisiana, California, and New Jersey—ranging from 6.36% to 6.41%.

At the other end of the list, today’s five highest-rate states are Hawaii, Nevada, Massachusetts, Utah, and New Mexico, all between 6.57% and 6.60%.

Mortgage rates vary slightly from one state to another based on factors such as lender competition, borrower credit profiles, average loan size, and local regulations. Mortgage lenders also manage risk differently across markets, which can nudge averages up or down from state to state.

But as you can see, the overall range is narrow—only about a quarter of a percentage point from lowest to highest.

Why This Matters to You

Even though mortgage rates remain higher than many buyers would like, they’re still near their lowest levels in more than a year. If you’re house hunting, you’re often better off moving forward when you’re financially ready and the right home comes along, rather than waiting for the “perfect” rate.

What Today’s Mortgage Rate Picture Looks Like

The national average for 30-year fixed mortgages is 6.48%—about an eighth of a point higher than 10 days ago, when rates hit an almost 13-month low of 6.35%. Even so, they remain close to their lowest levels since 2024.

Some buyers may have expected mortgage rates to fall after the Federal Reserve cut its benchmark rate at the end of October. But instead, rates edged higher. That’s because the Fed’s short-term rate doesn’t directly influence long-term mortgage rates, which take more of their cues from the 10-year Treasury yield, inflation trends, and other broad economic factors.

Important

The rates shown here are averages and won’t match the teaser offers often advertised online. Those advertised rates are usually cherry-picked to look most attractive and may assume points paid upfront or a borrower with exceptional credit and a smaller-than-average loan. Your actual rate will depend on factors like credit score, income, and loan size, so it may differ from the averages shown here.

Hoping to Buy a Home? Don’t Wait for the Perfect Rate

If you’re wondering whether to act now or wait for lower rates to buy a new home, most forecasts point to only modest relief ahead. Fannie Mae and other major outlooks see 30-year mortgage rates holding in the mid-6% range through the end of this year, with gradual declines possible—but not guaranteed—in 2026.

Even if rates drop in the next few weeks or months, the change may not be big enough to outweigh the risk of missing out on the right home. What matters most is being financially ready—with manageable debt, steady income, and enough saved for a down payment—so you can move when the right opportunity comes along.

Waiting for a perfect rate could mean sitting out a good buying window. Acting when you’re ready—and when a home fits your needs and budget—can be the smarter move. Remember: you can always refinance if rates fall in the future.

How We Track the Best Mortgage Rates

The national and state averages cited above are provided as is via the Zillow Mortgage API, assuming a loan-to-value (LTV) ratio of 80% (i.e., a down payment of at least 20%) and an applicant credit score in the 680–739 range. The resulting rates represent what borrowers should expect when receiving quotes from lenders based on their qualifications, which may vary from advertised teaser rates. © Zillow, Inc., 2025. Use is subject to the Zillow Terms of Use.