I just lately reviewed the idea of retirement calculator fidelity. Retirement calculators fluctuate significantly. They vary from easy instruments with a couple of inputs and outputs to superior instruments on par with skilled monetary planning software program.

As completely different as these instruments are, they’ve one factor in widespread. Nearly each retirement calculator offers you a measure of your chance of retirement success or failure. They current this as a dichotomy and outline success and failure the identical means.

So it’s value taking a step again. We’ll discover how success and failure are outlined by these calculators, whether or not that matches your private definition of success or failure, and how one can interpret this retirement calculator output as you employ these instruments to help your planning.

Retirement Calculator Definitions of Success and Failure

Retirement calculators in any respect constancy ranges are inclined to current two widespread outcomes:

- % Probability of Success or Failure

- Success is a terminal steadiness > $0

- Failure is a terminal steadiness of ≤ $0

- Median and/or Vary of Terminal Account Steadiness

- Y-axis is account steadiness

- X-axis is years into retirement

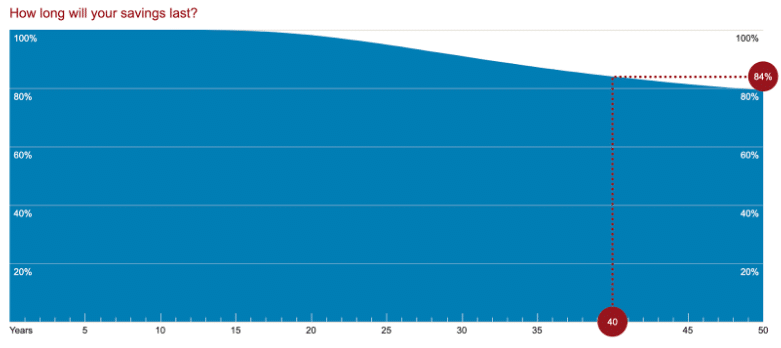

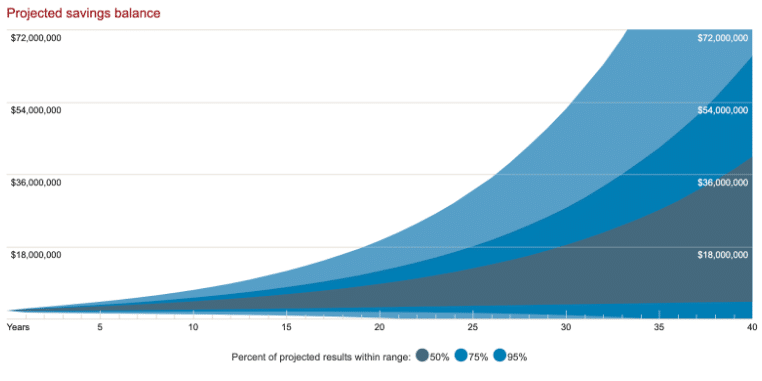

For example of a low-fidelity calculator output, Vanguard’s Retirement Nest Egg Calculator supplies a % success given an outlined retirement interval.

This software additionally presents the vary of terminal account balances in graphical kind based mostly on a thousand eventualities calculated with Monte Carlo simulations.

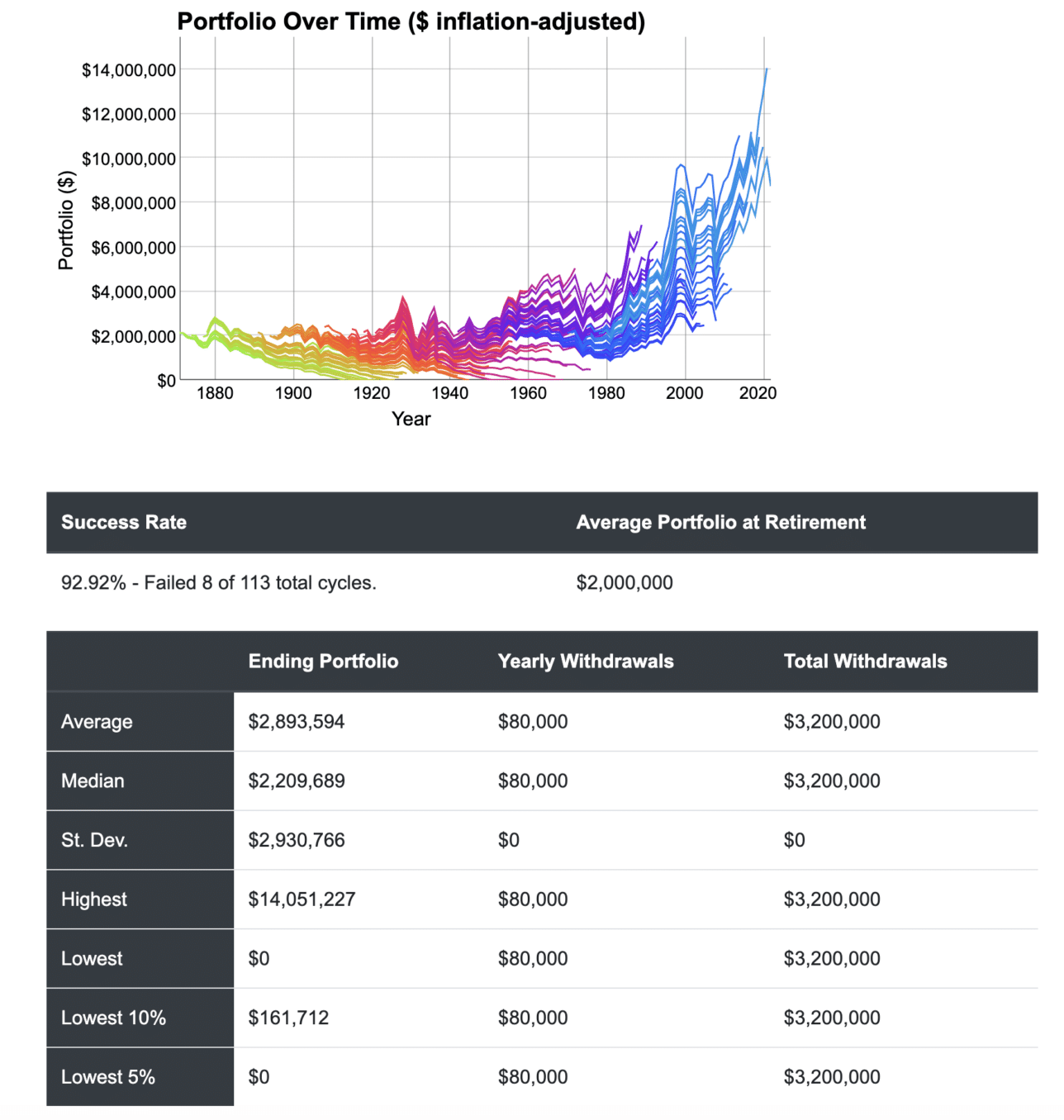

cFIREsim is a medium-fidelity calculator that fashions historic returns, so the graphical output appears a bit completely different than that created with Monte Carlo evaluation. A more in-depth look exhibits that you simply nonetheless get a % chance of success/failure and all kinds of ending balances.

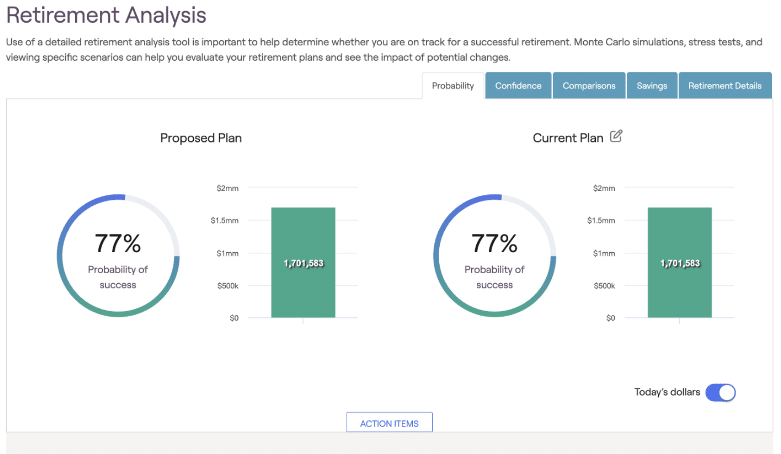

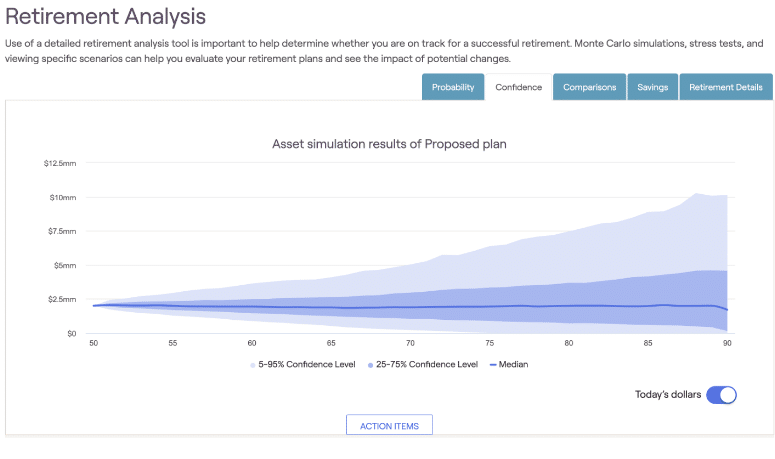

Let’s spherical this dialogue out with the instance outputs from RightCapital, the skilled monetary planning software program I exploit with purchasers.

You’ll see a well-recognized wanting % success/failure with the median ending account steadiness.

And returning to Monte Carlo evaluation, you get a graphical show exhibiting a variety of potentialities of terminal account balances.

Are All “Failures” Created Equally?

Every of those examples present the same case scenario entered into different retirement calculators. In that situation, I assumed a married couple the place every particular person retired concurrently at age 50.

A failure is outlined by every of the calculators as their portfolio hitting the X-axis on the graph (i.e. $0 account steadiness) earlier than the tip of their plans, no matter when this happens. Let’s take into consideration the logic of this.

Early Failures

Think about retiring at age 50. Fifteen years into retirement you fully exhaust your funding portfolio. You at the moment are 65 years outdated and broke.

Smaller Social Safety Profit

Presumably, somebody who retires at age 50 wouldn’t have 35 years of incomes historical past for Social Safety. Due to this fact they’ve a smaller profit than they may have amassed in the event that they labored longer.

Associated: How Does Retiring Early Impact Social Security Benefits?

Much less Social Safety Claiming Choices

Somebody on this place would need to delay claiming Social Safety to maximise their profit they’ve earned to offer the best spending energy in addition to longevity insurance coverage. Nevertheless, they would want earnings now, limiting their claiming choices.

Associated: When to Take Social Security

Simply Go Again to Work?

There’s a widespread chorus within the FIRE neighborhood that within the worst case situation of retiring too early and working out of cash, you possibly can all the time “simply return to work.” Nevertheless, in case you run out of cash at age 65, and even in case you notice you might be on that trajectory in your late 50’s or early 60’s, you’d have been out of your profession for a very long time.

In most careers, you possibly can’t “simply return” after a decade. Abilities could have atrophied. Social networks could have weakened. Licenses and certifications could have expired. You could not have the well being you probably did.

Choices could also be restricted to low-skilled, and thus typically low-paid, work. Or it’s possible you’ll not have the well being to work in any respect.

Associated: Going Back to Work

Failures that happen at this level are apparent factors of concern. You’ll need to contemplate the elements that might result in this poor consequence and plan rigorously to stop them or intervene early if you end up on this trajectory.

Late Failures

Now think about the identical retirement situation, however simulated “failures” don’t begin occurring till age 85 relatively than age 65. Working out of cash is rarely fascinating. Nevertheless, it’s value acknowledging that this “failure” is sort of completely different from working out of cash twenty years earlier.

Will You Nonetheless Be Round to “Fail”?

For starters, there’s a cheap probability it’s possible you’ll not nonetheless be alive at age 85. Social Security’s Life Expectancy Calculator exhibits {that a} 50 yr outdated male has a life expectancy of solely 82.0 years (85.5 years for females).

It’s true that now we have to plan for our personal particular person case (two people if you’re a part of a pair) and we will’t depend on averages. Nonetheless, we’d like to concentrate on chances and concentrate on the more than likely eventualities.

Many individuals need to mannequin plans to age 100 or longer. A unique longevity calculator from the UK Office for National Statistics means that you can calculate the chances of changing into a centenarian. For a 50 yr outdated male, your probabilities of dwelling to 100 are 4.6%. For a feminine, 7.8%.

You possibly can’t ignore the potential for an extended life, however you possibly can plan for it. Delaying claiming Social Safety means that you can maximize this inflation-adjusted supply of lifetime earnings. Somebody who reaches their mid-60’s with a wholesome portfolio steadiness might simply afford this choice.

They might additionally contemplate annuitizing a portion of their portfolio to ensure lifetime earnings, insuring towards longevity danger.

Associated: Annuities – The Good, The Bad, and the Ugly

Decreased Spending With Age

Statistics present that spending decreases over time after age 65 for Americans across the wealth spectrum. This can be a distinction to retirement modeling which usually assumes constant actual spending, or spending that will increase as a result of inflation. Factoring in decrease spending later in life would lower the chances of failures.

All of us want to contemplate our particular person circumstances. They embrace private spending/giving targets, chance for longevity, and tolerance for danger.

Universally, we will agree {that a} situation of working out of cash late in retirement isn’t as dangerous of an consequence as working out early. All failures should not equal.

A Nearer Take a look at “Success”

Retirement calculators outline success as any consequence the place your terminal account steadiness is larger than zero. In different phrases, dying with $1 in your checking account is taken into account a “success” simply the identical as dying with a $20 million portfolio.

Take a step again and apply a bit little bit of widespread sense. You’ll shortly see the issue with this definition of success.

Shut Calls

A e book that has generated a whole lot of buzz over the previous few years is Invoice Perkins’ Die With Zero (link to my review of the book).

Die With Zero = Final Success?

In Perkins’ framework, any cash you continue to have at your demise represents a waste of your life vitality. That is cash you didn’t must spend time incomes or cash that might have been spent on experiences to enhance your life. Taking your final breath with $1 in your checking account could be considered as the last word success.

In actuality, we don’t know what day we’ll be taking our final breath. So the one solution to actually “die with zero” whereas sustaining your required life-style is to optimize Social Safety, be fortunate sufficient to have a beneficiant pension, and/or convert your property into annuities that present desired earnings for all times whereas leaving no residual profit.

Die With Zero = A Disturbing Finish?

Social Safety solely covers a portion of desired spending wants for most individuals. Not many individuals have pensions, and the quantity is getting smaller over time. Many individuals don’t need to place their complete monetary future within the palms of insurance coverage corporations.

So many people will finally both die with some residual account steadiness or exhaust our portfolio. Seeing balances dwindle whilst you doubtlessly nonetheless have life left can produce stress and anxiousness. Experiencing this is able to not be most individuals’s definition of “profitable” retirement, no matter what your calculator and a well-liked e book say.

Ending Retirement With Extra Than You Began

On the different finish of the “retirement success” spectrum, you possibly can find yourself with an inflation adjusted portfolio that’s a number of occasions your starting portfolio. That is very true for early retirees.

When you’ve got a superb early sequence of returns and don’t enhance your spending and/or giving considerably, your investments can develop to eye popping numbers after a number of a long time of compounding. However is beginning retirement with $2 million and ending it with $10 million your definition of success?

Massive Ending Balances = Safety?

Some folks need to create retirement eventualities which have a 100% probability of success. They see the safety this supplies as well worth the trade-offs.

To be clear, these trade-offs imply beginning with a really low drawdown fee resulting in bigger ending balances than you began with. The worth of insuring towards each attainable worst case situation means in most circumstances you’ll have considerably over saved.

This can be a aware choice for some folks. In that case, that’s your choice to make.

Massive Ending Balances = Missed Alternatives?

Once I focus on this subject with purchasers I typically return to their acknowledged targets. Widespread examples are to have a cushty retirement, to spend time with children and grandkids, to journey, and so forth.

I steer the dialogue to the dueling dangers of retirement planning. There’s a danger you possibly can run out of cash earlier than you run out of life. The other aspect of this coin is you possibly can run out of life earlier than you run out of cash.

Safety centered folks are inclined to concentrate on the previous and ignore the latter. Retirement calculator outputs can reinforce this mind-set.

{Dollars} left on the finish of life, notably when they’re within the tons of of hundreds and even tens of millions could characterize missed alternatives to create extra life enriching experiences with household and buddies and provides extra generously when you might have the chance to understand the impacts.

Defining Success and Failure for Your self

You get to resolve the way you outline retirement success and failure. The purpose is that retirement successes and failures as outlined by retirement calculators should not all created equally.

In my subsequent submit, I’ll proceed on this theme and focus on higher methods of utilizing retirement calculators to help planning, what an appropriate fee of success or failure is in calculations, and methods of planning for uncertainty. Till then, I problem you to replicate on these concepts.

When you’ve got a propensity to focus solely on safety, learn the concepts Perkins’ shares in Die With Zero. If you’re assured you doubtless have already got sufficient (or extra), take a look at Mike Piper’s e book More Than Enough for sensible concepts of utilizing the wealth you’ve created to reinforce your life and the lifetime of others.

How do you outline retirement success and failure? Let’s discuss it within the feedback beneath.

* * *

Worthwhile Sources

- The Finest Retirement Calculators can assist you carry out detailed retirement simulations together with modeling withdrawal methods, federal and state earnings taxes, healthcare bills, and extra. Can I Retire But? companions with two of one of the best.

- Free Journey or Money Again with bank card rewards and join bonuses.

- Monitor Your Funding Portfolio

- Join a free Empower account to achieve entry to trace your asset allocation, funding efficiency, particular person account balances, internet value, money circulate, and funding bills.

- Our Books

* * *

[Chris Mamula used principles of traditional retirement planning, combined with creative lifestyle design, to retire from a career as a physical therapist at age 41. After poor experiences with the financial industry early in his professional life, he educated himself on investing and tax planning. After achieving financial independence, Chris began writing about wealth building, DIY investing, financial planning, early retirement, and lifestyle design at Can I Retire Yet? He is also the primary author of the book Choose FI: Your Blueprint to Financial Independence. Chris also does financial planning with individuals and couples at Abundo Wealth, a low-cost, advice-only financial planning firm with the mission of making quality financial advice available to populations for whom it was previously inaccessible. Chris has been featured on MarketWatch, Morningstar, U.S. News & World Report, and Business Insider. He has spoken at events including the Bogleheads and the American Institute of Certified Public Accountants annual conferences. Blog inquiries can be sent to chris@caniretireyet.com. Financial planning inquiries can be sent to chris@abundowealth.com]

* * *

Disclosure: Can I Retire But? has partnered with CardRatings for our protection of bank card merchandise. Can I Retire But? and CardRatings could obtain a fee from card issuers. Some or the entire card gives that seem on the web site are from advertisers. Compensation could affect on how and the place card merchandise seem on the positioning. The location doesn’t embrace all card corporations or all accessible card gives. Different hyperlinks on this web site, just like the Amazon, NewRetirement, Pralana, and Private Capital hyperlinks are additionally affiliate hyperlinks. As an affiliate we earn from qualifying purchases. In case you click on on considered one of these hyperlinks and purchase from the affiliated firm, then we obtain some compensation. The earnings helps to maintain this weblog going. Affiliate hyperlinks don’t enhance your price, and we solely use them for services or products that we’re acquainted with and that we really feel could ship worth to you. Against this, now we have restricted management over many of the show adverts on this web site. Although we do try to dam objectionable content material. Purchaser beware.

[ad_2]

Source link